Demo Room

Live Sessions

2:00 PM - 2:20 PM BST

See the Bigger Picture: FI and FX Move Beyond Reporting to Actionable Analytics and Data APIs Deliver Even More Detail

Michael Sparkes

Head of Analytics Business Development, EMEA

Ruben Costa-Santos

Head of Multi-Asset TCA

3:00 PM - 3:20 PM BST

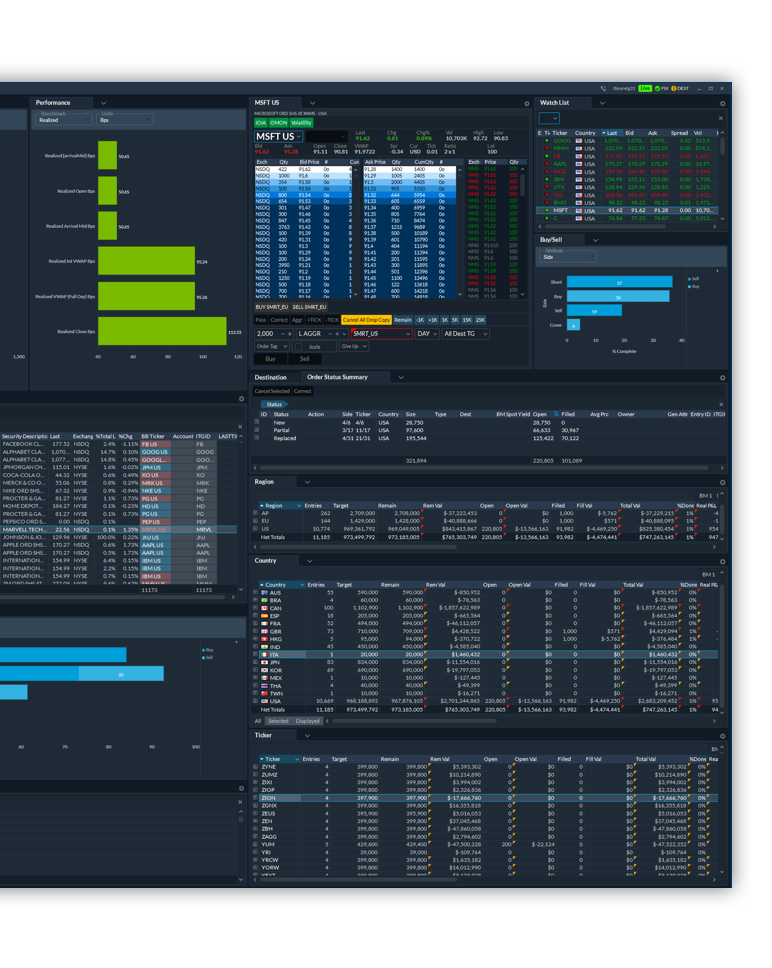

Even Better Together: Workflow Tools like Automation, Algo Wheel and Triton use Analytics and Data to Confirm Execution Decisions

Melissa Ellis

Triton EMS Product Manger, EMEA

Matthew Stengel

Head of Analytics Client Services, EMEA

Pre-Recorded Demos